Author: Gerard Ukwe;

Saving for retirement is one of the most important economic goals for all whether men or women. While saving for your retirement is a big step for all, women face so many kinds of unique problems which should be taken seriously in their plans.

A problem women suffer is the fact that they have but a few years for work. This reason is because, women are more likely than to take leave from their work in order to raise children, and most times interrupt their careers to take care of elderly parents.

Because of little income and fewer years working, women have less possibility of saving toward their retirement than men. They also save less when they make contributions.

“Another problem women face is the tendency of women to be conservative investors than men”. Although there is usually a place for conservative investment in most portfolios, investing extremely conservatively will certainly cause a decrease in savings and even diminished investments for retirement.

Some economic tips geared towards women in order to prepare them better for their retirement include:

#1. Working harder and be self-disciplined.

There are many ways for this to work, but all requires discipline and diligence. One way is to go for a high-paying job and can save as much as you can. Another way is to invest and to invest aggressively.

#2. Having saving as your priority.

Some women get side-tracked when trying to balance obligations concerning finance. They should not forget to think of caring for their future and saving for their retirement.

Read Also:

-

Things to Do Differently in 2019 for Positive Change

-

Money Moves To Make For 2019

-

Living Cheaper In An Expensive City

-

Marketing Ideas to Steal From Your Competitors

-

Method To Make At Least $5K Per Month From Facebook

#3. Invest more.

Women should consider making investment more than men to guarantee a longer lifespan. Women must consider their risk tolerance and time frame so they can invest better and accomplish their goals.

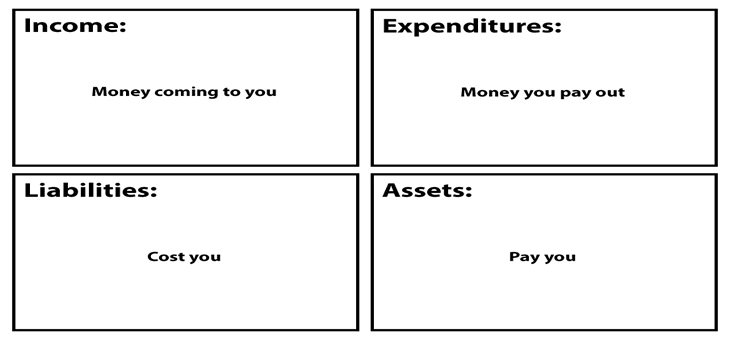

#4. Convert your savings to income.

Check your income options and build a plan so that you may have an income from the first day you retire. Some options are annuities and unsheltered savings.

You may want to talk to a financial counselor to help you make a plan in order to meet your needs in your retirement phase. It may be a good time to rethink your investment goals and readjust your investments(when necessary)

#5. Pay your debts off.

You should pay your debts off as soon as possible – ideally before your retirement.

In order to pay your debts off quickly, be sure you pay the lowest interest rate you can possibly have.

#6. Make your budget.

Find out the amount you will spend in order to be in charge during retirement, then check if it corresponds with your monthly income. If it doesn’t match with your income, you”ll have to discover ways on how to save more, cut spending or increase your income in retirement.

#7. Go for income producing assets (Get income-producing assets only).

Try to live conservatively, acquire a multiple-family home rather than a one-family home, this is because the rents will offset the expense of home ownership. Buy automobiles you can have for at least six years. Go for good quality stocks that pays consistent dividends. Later, the absence of debts and less expensive living lifestyles together with your income assets will make it all happen.

#8. Start investing heavily and early; (Will you retire early, then invest early).

Even if you may earn more in your 30s and able to make more contributions, waiting till then will not be sufficient if you have to retire early. A good suggestion is to invest heavily in your early age, this is because your acquired wealth will have more than twenty years to enjoy the benefits of compound interests. An extra plus is that you will spend less of your capital during the process.

#9. Make your stock market investment carefully.

If you save well and have just a little amount of cash at hand, making investments in the market is very lucrative (but also risky) way to make some extra money. Before you invest in stocks, it is very necessary to know that the money you invest can potentially get lost, especially when you don’t really understand what you are doing, so better don’t use this method for long-term saving.

Treat the stock market as a way of making intelligent gambles with the money, because you can actually have some loss. Generally, many don’t have to make investments in the stock market in order to save for their retirement.

If you are discouraged about your financial status, you may need to consult a financial counselor. Financial counseling services often operate for free, or at low cost, they are a great rescue option that exists to help you make savings that will perfectly correspond with your financial goals.

Develop a good habit of exercising on the airtrack -

February 27, 2019[…] Women in charge, best tips to help prepare for your retirement. […]